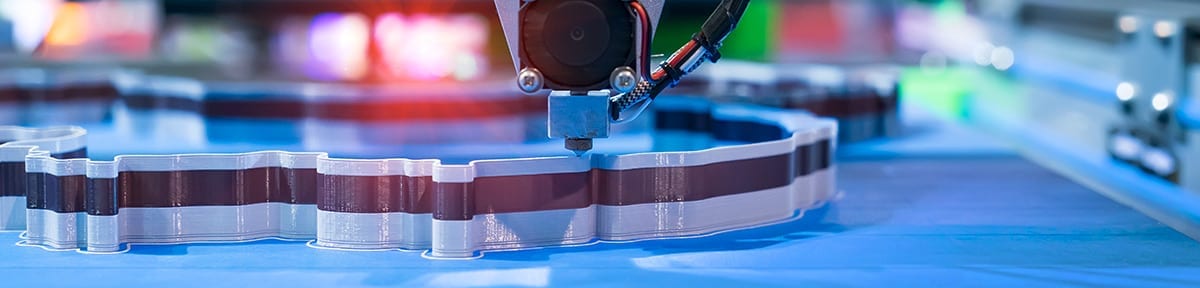

From schools and public libraries to the Department of Defense and industry, additive manufacturing and 3D printing technology is being used everywhere. Additive manufacturing (AM) encompasses many technologies, including subsets like 3D printing, rapid prototyping, direct digital manufacturing, layered manufacturing and additive fabrication. As a process, additive manufacturing uses a computer-aided design (CAD) file to precisely control layer-by-layer, or point-by-point, buildup of material into three dimensional objects. The National Center for Manufacturing Sciences (NCMS) sees AM an emerging technology with many promising applications for both industry and Government including:

- Rapid iterations of prototyping, reducing time and money for design

- Reduction in wait time

- Enabling of just in time manufacturing on site at locations

- Support of immediate readiness

- Small, unique production runs

In July of 2019 the U.S. Department of Energy (DOE) published Solving Industry’s Additive Manufacturing Challenges providing a comprehensive look at AM in the U.S. and the Department’s role in this dynamic market. DOE estimates that AM might reduce waste and materials costs by nearly 90% and cut manufacturing energy use in half when compared to traditional manufacturing practices. DOE’s Advanced Manufacturing Office (AMO) provides information on funding opportunities, roadmaps, strategic plans, and events and its AMO Multi-Year Program Plan (FY 2017- FY 2021) includes additive manufacturing as a technology area covered in the plan.

Within the U.S. Department of Defense (DoD), an integrated DoD Additive Manufacturing (AM) Roadmap was published in December 2016 and strategic implementation plans for AM have been independently produced by the USAF and the U.S. Department of the Navy (DON), and the U.S. Army has also developed a draft AM technology report. While each Service has its own plan and system for AM research, all the services are members of the National Manufacturing Institutes, or “Manufacturing USA” which is a public-private partnership, jointly funded by government and private industry, focused on advanced manufacturing, including additive manufacturing. Through Manufacturing USA the America Makes Institute in Youngstown, OH is focused on additive manufacturing (AM) and has funded more than 60 projects since it was founded in 2012. The 2020 Military Additive Manufacturing Summit & Technology Showcase is coming up in February.

To help quantify this market, BCC Research reports that the global market for 3D printing reached $10.2 billion in 2019 and should reach $27.5 billion by 2024, at a compound annual growth rate (CAGR) of 22.0% for the period of 2019-2024. As a whole, the global manufacturing industry grew at a 3% rate year-on-year in 2019, contributing 30% to the global GDP. This total industry growth is attributed to new technologies including automation, 3D printing and a marked increase in automobile and electronics production. From a capabilities standpoint, the ability to 3D print metal materials is an exciting ongoing development – given that the process uses no tooling, is almost fully automated, and adds rather than removes material to allow for more optimized geometries makes metal 3D printing into an attractive option for parts that might typically be very difficult or expensive to manufacture, including legacy parts, line automation tools, and functional cast prototypes manufacturing. These features are especially attractive in automotive and defense applications.

Key participants in the additive manufacturing space include 3D Systems Inc., General Electric, EnvisionTEC, Mcor Technologies Ltd., Optomec Inc., Stratasys Ltd, EOS GmbH, The ExOne Company and MakerBot Industries, LLC. While this has been a highly concentrated industry, AMFG’s Additive Manufacturing Landscape offers a detailed overview of the key players and categories within the additive manufacturing industry and includes 171 different players.

Hoping to learn more? Try attending an upcoming additive manufacturing event in 2020!