Operating in extreme environments presents many technical challenges. When these environments include the demands of hypersonic flight in the upper atmosphere, the challenges are even greater. The Congressional Research Service reports that the U.S. Department of Defense (DoD) is pursuing two types of hypersonic weapons technologies: boost-glide systems that place a maneuverable glide vehicle atop a ballistic missile or rocket booster, and cruise missiles that would use high-speed, air-breathing engines to travel to hypersonic speeds.

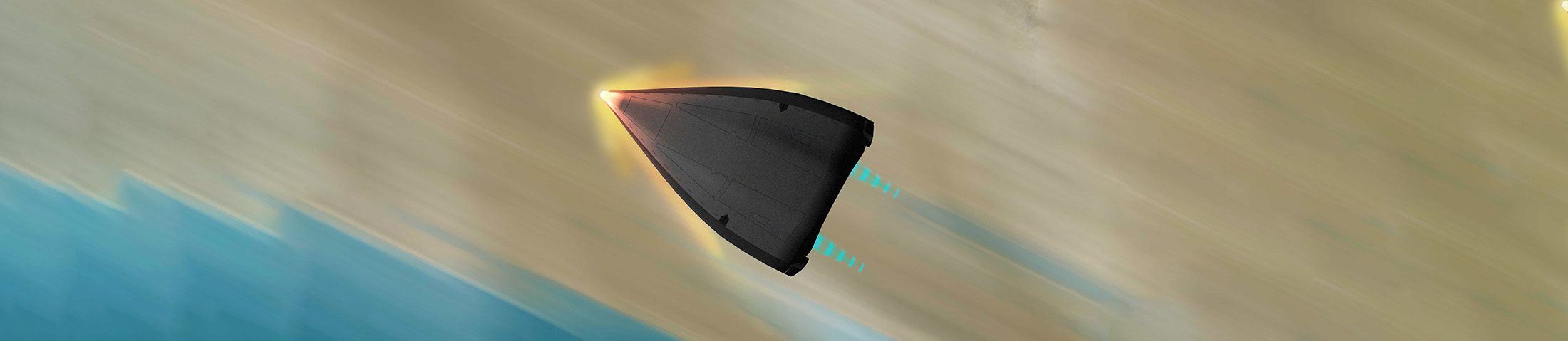

A leading difference between missiles armed with hypersonic glide vehicles (HGVs) and missiles armed with ballistic reentry vehicles is their ability to maneuver and change course after they are released from their rocket boosters. Furthermore, hypersonic vehicles operating in the upper atmosphere are subject to extreme speeds, these may exceed Mach 5, which is five times the speed of sound. These vehicles may also experience temperatures of over 1,000 degrees Celsius, oxidation from the atmosphere and tremendous aerodynamic shear loads. In addition to materials and coatings able to withstand these extreme environments, these platforms will necessitate flight control systems that are able to make rapid adjustments in response to the surrounding and rapidly changing flight conditions.

Despite these challenges, analysts report that the hypersonic missile market is expected to be valued at $130.50 million by 2028 at a compound annual growth rate (CAGR) of 2% during the forecast period (2023-2028). Deloitte notes that in the United States, annual unclassified defense spending requests for hypersonic technology have grown at a 26% CAGR since 2014 and already total more than $2.6 billion. This annual domestic spending is expected to grow to $5 billion by 2025 while the international hypersonic market was predicted to grow at a CAGR of 7.23% between 2018 and 2022. Furthermore, the hypersonic market has received more than $328 million in venture capital investment since 2015.

The development of hypersonic platforms and enabling technologies is being carried out by groups including prime contractors, government and universities, and small businesses. The leading prime contractors appear to be Lockheed Martin and Raytheon. Raytheon’s Hypersonic Air-breathing Weapon Concept (HACM) leverages Northrop Grumman scramjet propulsion system with the team reportedly on schedule to deliver a system to the Air Force, which has said it plans for the missile to be operational by fiscal year 2027. Lockheed Martin is partnering with the U.S. Navy to integrate hypersonic strike capability onto surface ships with the Conventional Prompt Strike (CPS) weapon system that will be integrated onto ZUMWALT-class guided missile destroyers (DDGs). The CPS is a hypersonic boost-glide weapon system that enables long range missile flight at speeds greater than Mach 5, with high survivability. Additionally, the Missile Defense Agency (MDA) is developing systems to counter hypersonic missiles with its Glide Phase Interceptor, which is a missile designed to shoot down a hypersonic weapon in the middle (or glide phase) of its flight.

In terms of research and development activities for enabling capabilities, researchers at the Johns Hopkins Applied Physics Laboratory (APL) are developing coatings that can stand up to the extreme environments of hypersonic flight in the upper atmosphere. The University of Texas at San Antonio is working on Pressure-Sensitive Paint Measurements of a Hypersonic Vehicle in support of NASA’s ULI Full Airframe System Technology (FAST), and the University of Virginia is also working on advanced hypersonic materials. To learn more about research and innovation in hypersonics there are several conferences happening in 2023 and 2024 – the 5th Annual Hypersonic Weapons Summit takes place in September and 3rd National Summit on Hypersonic Weapons Systems is happening in April 2024.