Clean Coal

Cleaner & more efficient use of coal as fuel and conversion of coal & coal waste into high-value products

- Overview

- Roadmaps

- Resources

- Technology Gaps

- Conferences

Clean Coal Overview

Advanced coal technologies encompass both lower-emissions and more efficient use of coal as fuel and novel ways of converting coal and coal waste into high-value products.

While the American coal industry has been in decline for decades, the advancement of coal technology is receiving renewed attention under the Trump administration. U.S. coal production peaked in 2008. U.S. coal consumption peaked in 2007 and decreased 64% by 2024, largely due to coal-fired power plant retirements. Coal constituted just 8% of primary energy consumption in the U.S. in 2024. At the same time, the U.S. has the largest coal reserves and resources in the world, with about 11 billion short tons of recoverable domestic coal reserves as of 2023, according to the U.S. Energy Information Administration (EIA).[1] By way of introduction, the following briefly discusses the U.S.’s geographic distribution of coal production, top greenhouse gas (GHG) emitting coal-fired power plants, and major DOE R&D efforts.

U.S. Coal Production

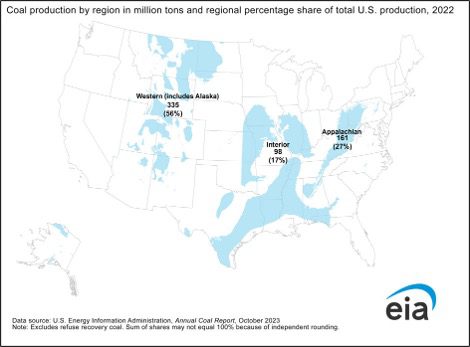

In the U.S., coal is mainly found in three regions: the Appalachian, Interior, and Western coal regions, as identified by the U.S. Energy Information Administration (EIA).[1]

Source: U.S. EIA, 2023

In 2023, the most recent year for which EIA data is available, 29% of U.S. coal production came from the Appalachian coal region, 16% from the Interior, and 55% from Western coal region.[2]

The largest coal field in the country is in the Powder River Basin in Montana and Wyoming.[3] Wyoming, the top coal-producing state, was responsible for 41% of U.S. coal production in 2023.[2] The top 5 coal-producing states in 2023, collectively accounting for 74% of production, were:

- Wyoming (41%)

- West Virginia (15%)

- Pennsylvania (7%)

- Illinois (6%)

- Montana (5%)

(See EIA’s 2023 Annual Coal Report, Table 1: Coal Production and Number of Mines by State and Mine Type for more detail.) Significant coal production occurs on federal lands. In 2023, all coal produced in Wyoming and over 1/3 of coal produced in Montana came from federal lands.[4]

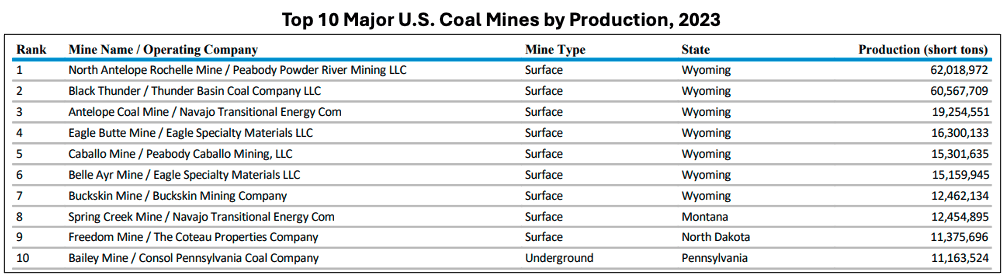

The 10 highest-producing U.S. coal mines as of 2023 were:

Source: U.S. EIA, 2024

Top GHG-Emitting U.S. Coal Power Plants

Based on the most recent EPA Greenhouse Gas Reporting Program (GHGRP) data available in the FLIGHT (Facility Level Information on GreenHouse Gases Tool), the top 25 GHG-emitting coal power plants, as of 2023, are shown in the table below.

Source: U.S. EPA FLIGHT data, 2023

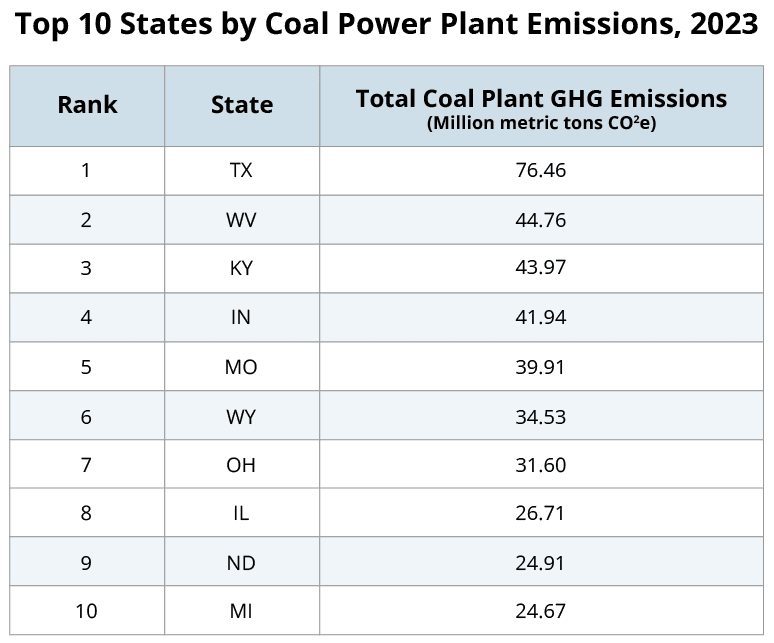

Based upon the same EPA data from 2023, the states that emitted the most GHGs from coal power plants are shown in the table below. In order, they are Texas, West Virginia, Kentucky, Indiana, Missouri, Wyoming, Ohio, Illinois, North Dakota, and Michigan.[6]

Source: U.S. EPA FLIGHT data, 2023

DOE Advanced Coal Technology R&D

The Office of Fossil Energy and Carbon Management (FECM), or simply Fossil Energy (FE), under DOE’s Office of the Under Secretary for Science and Innovation, is tasked with advancing technologies related to the affordable, reliable, and secure use of fossil fuels and the prudent and sustainable development of domestic coal as well as oil, gas, and critical minerals resources.[7] Several FECM programs support advanced coal technology R&D, such as:

Office of Carbon Management: priority areas include:

- Advanced energy systems (including efficiency improvement)

- Conversion and value-added products (including coal by-product conversion)

- Point-source capture (focused on coal)

- Hydrogen with carbon management (including gasification systems for converting coal into cleaner syngas)

- Also see NETL-managed carbon management programs.

Office of Resource Sustainability: priority areas include:

- Minerals Sustainability:

- Carbon ore processing (produce high-value products from coal)

- Critical minerals and materials (including advanced extraction technologies, e.g. from coal ash)

University Training & Research (UTR) Program:

- University Carbon Research (UCR) Program, administered by NETL

Roadmaps

Three of the most recent and relevant documents for understanding long-term federal advanced coal technology R&D priorities are DOE’s Fossil Energy Roadmap (2020), issued under the first Trump administration, and, issued under the Biden administration, the Long-Term Strategy of the United States Pathways to Net-Zero Greenhouse Gas Emissions by 2050 (2021) and Industrial Decarbonization Roadmap (2022).

DOE Fossil Energy Roadmap (2020)

The Fossil Energy Roadmap DOE submitted to Congress in September 2020 set the following coal, oil, and natural gas R&D priorities for DOE’s Office of Fossil Energy and Carbon Management (FECM), or simply Fossil Energy (FE) and related federal programs:

- “Develop the coal plants of the future by advancing small-scale modular coal plants of the future which are highly efficient and flexible, with near-zero emissions.

- Modernize the existing coal-fired fleet by improving its performance, reliability, and efficiency.

- Reduce the cost and risk of CCUS [carbon capture, utilization, and sequestration] to enable wider commercial deployment.

- Expand the use of big data by leveraging artificial intelligence to optimize coal plant performance, CO2 sequestration, and the recovery of oil and gas resources with real-time analysis informed by machine learning.

- Address the energy-water nexus by improving our efficient use of scarce water resources.

- Advance REEs [rare earth elements], critical materials, and coal products technologies by improving REEs separation and recovery technologies and processes to manufacture valuable products from coal, in order to address current global market and process economics.”[1]

In connection with these priority areas, the report identifies 4 general, enduring technical challenges:

- High-efficiency, low-emissions (HELE) power generation (focused on coal)

- Fossil energy integration, optimization, and resiliency

- Real-time decision science for the subsurface

- Manufacturing high-value carbon products from domestic coal. [2]

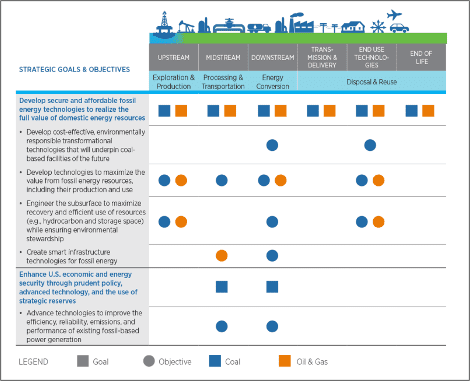

The roadmap then sets out these near-term R&D goals and objectives:

- Goal 1: Develop secure and affordable fossil energy technologies to realize the full value of domestic energy resources

- Objective 1.1: Develop cost-effective, environmentally responsible transformational technologies that will underpin coal-based facilities of the future

- Objective 1.2: Develop technologies to maximize the value from fossil energy resources, including their production and use

- Objective 1.3: Engineer the subsurface to maximize recovery and efficient use of resources (e.g., hydrocarbon and storage space) while ensuring environmental stewardship

- Objective 1.4: Create smart infrastructure technologies for fossil energy

- Goal 2: Enhance U.S. economic and energy security through prudent policy, advanced technology, and the use of strategic reserves

- Objective 2.1: Advance technologies to improve the efficiency, reliability, emissions, and performance of existing fossil-based power generation. [3]

DOE Office of Fossil Energy R&D Investment Spans the Value Chain

Source: DOE, 2020

Long-Term Strategy of the United States Pathways to Net-Zero Greenhouse Gas Emissions by 2050 (2021)

Released by the Department of State and Executive Office of the President in November 2021, the Long-Term Strategy of the United States Pathways to Net-Zero Greenhouse Gas Emissions by 2050 lays out 5 key strategic transformations:

- Decarbonize electricity

- Electrify end uses and switch to other clean fuels

- Cut energy waste

- Reduce methane and other non-CO2 emissions

- Scale up CO2 removal.[4]

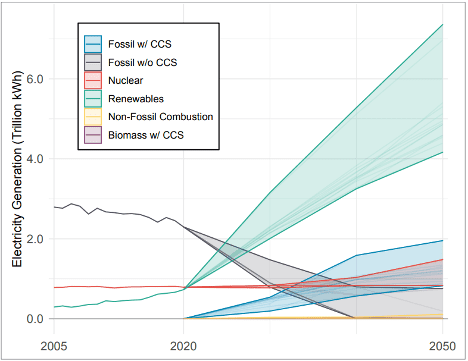

Renewable electricity generation surpassed coal generation for the first time in 2020.[5] The sharp decline in coal-based electricity generation is expected to continue. The strategy sets a goal of 100% zero-emission electricity generation by 2035, necessitating the phase-out of fossil fuel-based generation without CCS (carbon capture and storage), such as coal, oil, and gas. The shift toward renewables is projected to continue, while overall electricity demand goes up due to increased use of clean electricity in new applications in transportation, industry, and buildings.[6]

U.S. Electricity Generation by Source, 2005-2050

Source: Department of State & Executive Office of the President, 2021

Source: U.S. EIA, 2024

DOE Industrial Decarbonization Roadmap (2022)

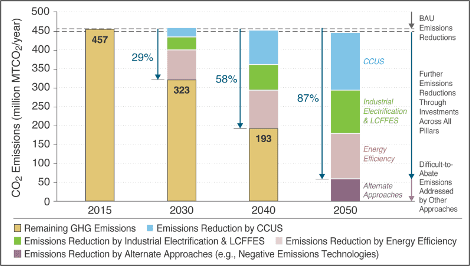

DOE’s Industrial Decarbonization Roadmap (2022) articulates 4 cross-cutting pillars of a decarbonization strategy to achieve net-zero carbon emissions by 2050:

- “Energy Efficiency: Energy efficiency is a foundational, crosscutting decarbonization strategy. Reducing the energy consumption of the industrial sector directly reduces GHG emissions associated with fossil fuel combustion.

- Industrial Electrification: As industry transitions from combustion fuels to electric power, it will be able to better leverage advancements in low-carbon electricity from both grid and onsite generation sources. For grid-purchased electricity, this strategy is predicated on the assumption of ‘greening of the grid’ – i.e., parallel advancements made in the electric power sector to increase use of nuclear, renewable, and low-carbon fuel sources and reduce combustion emissions.

- Low-Carbon Fuels, Feedstocks, and Energy Sources (LCFFES): Substitution of low-carbon fuels, feedstocks, and energy sources such as hydrogen, biofuels, or solar thermal power, can further reduce combustion-associated GHG emissions for industrial processes.

- Carbon Capture, Utilization, and Storage (CCUS): This multi-component strategy for mitigating hard-to-abate emissions sources involves capturing generated CO2 before it can enter the atmosphere, utilizing captured CO2 wherever possible, and storing captured CO2 long-term.”[7]

The Path to Net-Zero Industrial CO2 Emissions in the U.S. for 5 Carbon-Intensive Subsectors With Contributions from Decarbonization Pillars

Note: Subsectors include the iron and steel, chemicals, food and beverage, petroleum refining, and cement industries.

Source: DOE, 2022

The roadmap underscores the importance of replacing coal-based power generation with cleaner fuels, particularly in the iron and steel and cement industries, where coal is still the primary fuel source.

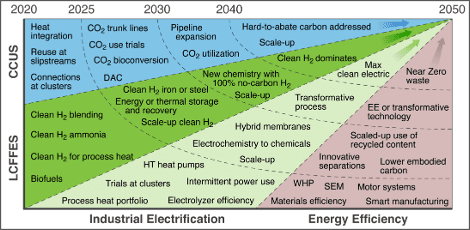

Landscape of Major RD&D Advancement Opportunities for Industrial Decarbonization by Decade and Decarbonization Pillar

Source: DOE, 2022

Resources

Background Documents

Clean Coal Technology Roadmaps (2003): International Energy Agency (IEA) report surveying earlier U.S. and international strategic planning efforts.

Clean Coal Technology Roadmap (2004): consensus-based roadmap released by DOE (led by the Office of Fossil Energy and National Energy Technology Laboratory or NETL), Coal Utilization Research Council (CURC), and Electric Power Research Institute (EPRI). Also see background document.

CURC-EPRI Coal Technology Roadmap overview (2012): conference presentation slides providing an overview of CURC and EPRI’s 2012 coal technology roadmap, focused on power generation and emissions abatement.

Status of DOE’s Clean Coal Program (2014): DOE Office of Fossil Energy and Carbon Management statement before Congress.

CURC-EPRI Advanced Fossil Energy Technology Roadmap (2018): most recent roadmap released by CURC and EPRI. Also see Executive Summary.

Technology Gaps

Advanced coal technology gaps are identified in a 2024 National Academies of Sciences, Engineering, and Medicine (NASEM) report and in the research agenda of DOE’s Carbon Ore Processing Program under the Office of Fossil Energy and Carbon Management (FECM).

NASEM Carbon Utilization Report (2024)

Commissioned by DOE, NASEM released its Carbon Utilization Infrastructure, Markets, and Research and Development: A Final Report in 2024. The report highlights CO2 and coal waste utilization technology gaps and makes recommendations for DOE and other government agency support in those areas. The report’s findings are summarized in chapter 11, “A Comprehensive Research Agenda for CO2 and Coal Waste Utilization.”

“For CO2 utilization, research needs exist for all conversion processes (mineralization, chemical, biological) and all product classes that can be derived from CO2 (construction materials, elemental carbon materials, fuels and chemicals, polymers).

For coal waste utilization, there are research needs across conversion and separation processes to generate carbon-based products (e.g., construction materials, elemental carbon materials) and extraction of critical minerals and rare earth elements.”[1]

The R&D needs NASEM points out are organized into 5 key areas: CO2 mineralization to inorganic carbonates, chemical CO2 conversion to elemental carbon materials, chemical CO2 conversion to organic products (e.g., fuels, chemicals, polymers), biological CO2 conversion to organic products, and coal waste utilization.

Some examples of technology gaps identified in the report are:

- CO2 Mineralization to Inorganic Carbonates:

- Construction materials produced via CO2 injection & curing methods – materials discovery and characterization of new forms of mineral carbonates to enable new cost-effective and efficient processing like 3D-printed concrete.

- Ocean-based carbon capture & utilization – full spectrum of R&D and demonstration activities for electrolytic brine & seawater mineralization (e.g., catalyst development, electrochemical cell design, membrane materials, systems engineering and integration).

- Chemical CO2 Conversion to Elemental Carbon Materials:

- CO2 to elemental carbon conversion (CTEC) technologies – maturation of thermochemical, electrochemical, photochemical, and plasma-chemical processes to make elemental carbon products.

- Greater efficiency through the combination of CTEC technologies.

- Integration of CO2 capture & CTEC technologies – improving integration to reduce costs and carbon footprint.

- Chemical CO2 Conversion to Organic Products:

- Thermochemical CO2 conversion – more efficient & carbon-neutral processes through catalyst development, alternative heating methods, and carbon-neutral reductants.

- Combination of thermochemical, electrochemical, photochemical, and/or plasmachemical processes – tandem catalysis for CO2 conversion to allow for creation of new products.

- Integrated CO2 capture & conversion – including discovery of molecules and materials, catalytic mechanisms, process optimization, CO2 stream purification, and reactor design.

- Biological CO2 Conversion to Organic Products:

- Pathway engineering & metabolic engineering to understand & overcome biochemical, bioenergetic, and metabolic limits – fundamental and applied research to enhance efficiency, titer, and productivity of photosynthetic, non-photosynthetic, and hybrid systems for chemical and polymer production.

- Genetic engineering tools to improve CO2 fixation & understanding of carbon metabolism – fundamental and applied research for chemical production, involving, e.g., computational modeling and machine learning.

- Hybrid electro-biological CO2 conversion – fundamental and applied research for chemical and polymer production to develop electrocatalysts with high activity, selectivity, and stability that operate under biologically amenable conditions.

- Coal Waste Utilization:

- Coal waste resources – enabling research for evaluation and mapping, including composition, volume, and locations.

- Extracting rare earth elements from coal waste – fundamental research for discovery and development of more selective & sustainable leaching agents, membranes, and processes.

- Efficient conversion of waste coal into carbon products with lower embodied carbon than existing ones – applied research and demonstration of, e.g., engineered composites, graphite, graphene, fiber, and foam, for use in construction, energy storage, transportation, and defense applications.

- Coal waste to 3D printing media – applied research into waste coal or coal-derived materials for tooling and building products.[2]

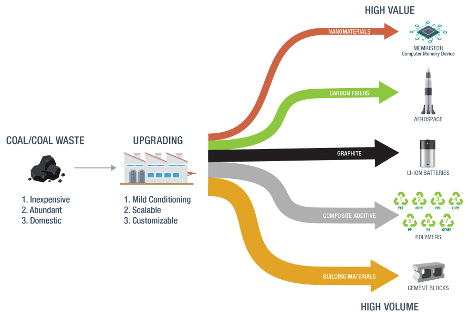

DOE Carbon Ore Processing Program

DOE’s Carbon Ore Processing Program, managed by NETL, was initiated in 2018 under the first Trump administration and was known as the Advanced Coal Processing Program until 2022.[3], [4]

Focusing on coal-to-carbon products, feedstock upgrading, and coal properties databases, its goals are to:

Current R&D areas include using coal to make building components, carbon fibers, nanomaterials, synthetic graphite (for energy storage and metallurgical applications), and additive enhancements for polymers and metals.[6]

NETL’s Carbon Ore Processing Program Focus Areas

Source: NETL, 2022

Conferences and upcoming major events

Carbon 2026: World Conference on Carbon

July 12-17, 2026 | Charleston, SC

Abstracts due December 19th, 2025

Held in the U.S. every 3 years, this carbon materials conference brings together members of the American Carbon Society, European Carbon Association, Carbon Society of Japan, and others from academia and industry.[1]

CO2-based Fuels and Chemicals Conference

April, 28-29, 2026 | Cologne, Germany & Online

Poster proposals due March 20, 2026

2026 marks the 14th CO2-based Fuels and Chemicals Conference, held by the nova-Institut research institute. Conference topics include: advanced research in carbon capture & utilization; CO2-to-polymers and materials; CO2-to-chemicals and materials; electrochemistry; green hydrogen production; innovation, strategy, and policy; photochemistry; power-to-X; power-to-fuels (transportation and aviation). The 2025 conference had about 230 attendees.

FECM / NETL Carbon Management Research Project Review Meeting

June 22-26, 2026 | Pittsburgh, PA

Attendees at this open-to-the-public meeting have a chance to share in the insights gained through more than 300 projects sponsored by the DOE Office of Fossil Energy & Carbon Management R&D programs in carbon conversion, point source carbon capture, carbon dioxide removal, carbon transport and storage, and hydrogen with carbon management.

International Conference on CO2 Mineralization in Construction Materials and Products

July 15-17, 2026 | Lisbon, Portugal

The 2nd International Conference on CO2 Mineralization in Construction Materials and Products (CMCMP2026), organized by Hunan University (China), Portugal’s National Laboratory for Civil Engineering (LNEC), and the Asian Concrete Federation, is being held in 2026 at LNEC. The conference facilitates exchange of knowledge and good practices and helps disseminate innovations among academic, public sector stakeholders, and industry. Sponsors include the American Concrete Institute, Rilem (International Union of Laboratories and Experts in Construction Materials, Systems and Structures), and the International Federal for Structural Concrete (FIB).[3]

International Conference on Carbon Dioxide Utilization (ICCDU)

June 21-26, 2026 | Boulder, Colorado

Abstracts due February 2, 2026

2026 marks the 23rd ICCDU, organized by the National Renewable Energy Laboratory (NREL), University of Colorado Boulder (CU Boulder) and the Renewable and Sustainable Energy Institute (RASEI). The 2024 conference attracted more than 500 attendees.[4]

International Conference on Catalysis, Chemical Engineering and Technology (CCT)

June 18-20, 2026 | Barcelona, Spain & Online

The 21st International Conference on CCT is being held in 2026 in Barcelona under the theme “Catalyzing Innovation: Connecting Chemistry, Engineering, and Technology for Tomorrow’s World,” organized by Magnus Conferences (Chicago, IL) for members of both academia and industry. The 2025 conference featured 30 speakers.

World Coal Science & Technology Innovation Conference & Global Coal Industry Expo

June 10-12, 2026 | Shanghai, China

Designed to bring together public sector, academic, and industry stakeholders, this conference focuses on coal markets and technologies in Asia.

World of Coal Ash (WOCA) Conference

May 4-7, 2026 | Lexington, KY

Abstracts due December 15, 2025

2026 is the 11th joint biennial World of Coal Ash (WOCA) is a biennial conference, organized by the American Coal Ash Association (ACAA) and the University of Kentucky Center for Applied Energy Research (CAER). The last event in 2024 had about 1,200 attendees.

Explore Other Energy Sources

Stay in the Know with Dawnbreaker®

Receive valuable industry insights such as our Market Snapshots, SBIR/STTR & TABA updates, & webinar announcements.