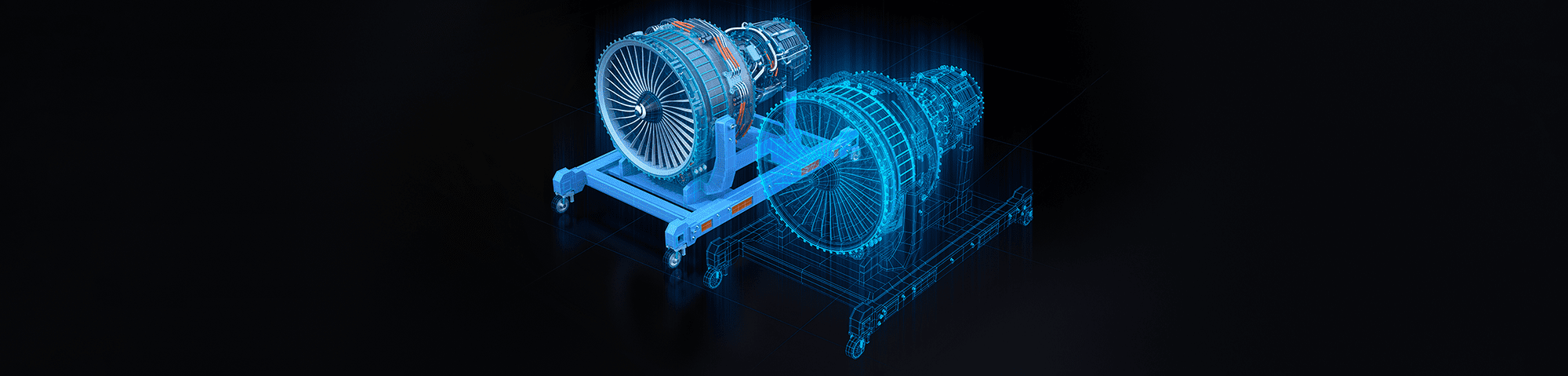

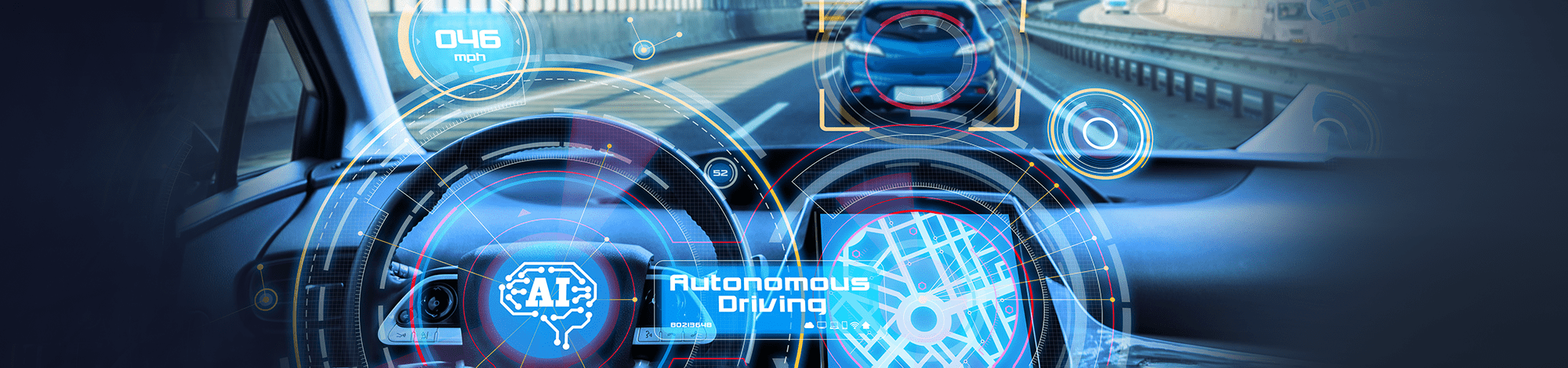

As technology increases in complexity, companies need a way to test a product before it exists in the real world. A digital twin is a virtual representation of a real-world object or process, used to simulate how something will function in the real world—a digital prototype. It’s a computer program that replicates the performance of an equipment, system, person, or process in real-time. However, unlike a simulation, a digital twin is a virtual environment designed around a two-way flow of information. The output of which can be significantly improved with the use of machine learning, artificial intelligence, and big data.

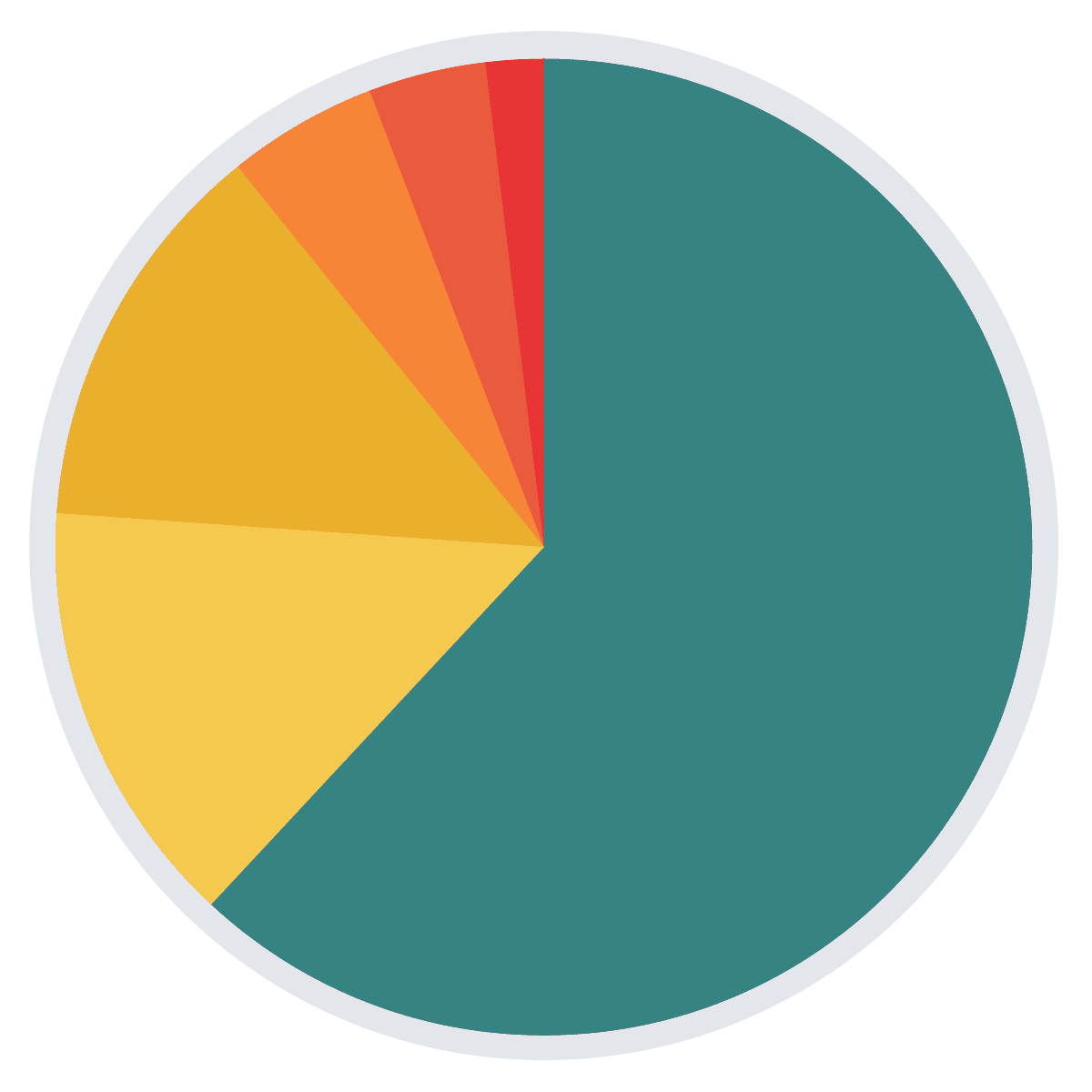

According to MarketsandMarkets, the global digital twin market is projected to reach $73.5 billion by 2027, up from $4.5 billion in 2021, which is a Compound Annual Growth Rate (CAGR) of 60.6%. The North American region is projected to lead the market as most of the digital twin providers are located in that region. Industries that benefit from this technology include aerospace, automotive, and biomedical among others. It is also useful in military, aeronautical, and maritime applications. Key players include General Electric, Microsoft, Amazon, and IBM. American aerospace companies, like Lockheed Martin and Boeing, also heavily invest in the technology for their R&D.

Major companies and research institutes, as well as start-ups, are getting involved in digital twin technology for various applications. Recently, researchers at Harvard and NTT Research announced a three-year joint effort to advance cardiac care using a cardiovascular bio digital twin model. Other researchers are working to create a digital twin of the immune system. There are also some environmental applications underway. Lockheed Martin and NVIDIA will build an AI-driven Earth Observations Digital Twin for the National Oceanic and Atmospheric Administration (NOAA). In Sweden, ClimateView has released an upgrade to its ClimateOS, which is essentially a digital twin for a city. The start-up’s SaaS platform will help planners effectively model efforts towards city decarbonization as countries transition to a net zero future.

Michael Grieves will speak at the IOT Solutions World Congress in early 2023. Grieves is generally recognized as the creator of the digital twin concept. Other events in 2023 include the Digital Twin Consortium’s free public forum, New York Build Expo’s event in March, and a conference for Oil & Gas Operations at the end of the year.